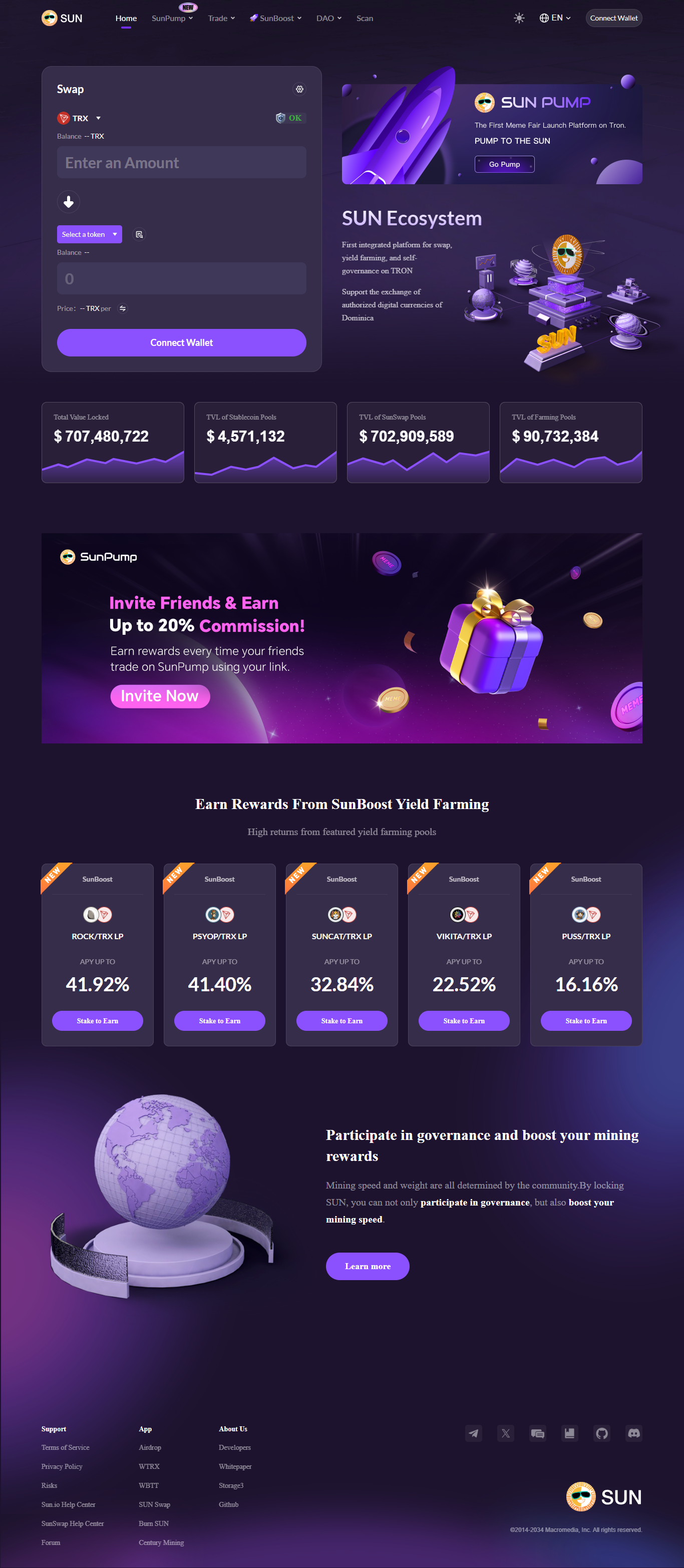

Exploring Sunswap Exchange: The Next Generation of Decentralized Trading on TRON

In the ever-evolving landscape of blockchain and decentralized finance (DeFi), Sunswap Exchange stands out as a pioneering decentralized exchange (DEX) built on the TRON network. As more users seek autonomy over their digital assets, Sunswap provides an intuitive, efficient, and highly secure platform for seamless token swaps, liquidity provision, and yield farming — all without intermediaries.

What is Sunswap?

Sunswap is TRON’s flagship DEX, enabling users to swap TRC-20 tokens directly on-chain. It is a fully decentralized protocol, governed by smart contracts, thereby eliminating the need for centralized control or custodial oversight. Sunswap evolved from JustSwap, TRON’s original DEX, and underwent significant upgrades to enhance scalability, user experience, and security.

At its core, Sunswap operates on an automated market maker (AMM) algorithm. Instead of relying on traditional order books, it leverages liquidity pools funded by users. This mechanism ensures constant liquidity and mitigates slippage, offering traders predictable pricing and near-instant settlement.

Key Features and Advantages

1. Decentralized and Trustless: Sunswap epitomizes the principles of DeFi by allowing peer-to-peer trades governed entirely by smart contracts. Users retain custody of their private keys, thereby safeguarding their assets from centralized exchange risks such as hacking or insolvency.

2. Cost-Effective Transactions: Thanks to TRON’s high throughput and minimal transaction fees, Sunswap facilitates lightning-fast swaps at a fraction of the cost typical on other chains like Ethereum. This affordability makes it attractive for retail users and high-frequency traders alike.

3. Liquidity Incentives: Sunswap empowers users to contribute to liquidity pools, earning a share of the trading fees proportional to their stake. Additionally, many pools are incentivized with SUN token rewards, enhancing the yield potential for liquidity providers.

4. Robust Ecosystem Integration: Being native to the TRON ecosystem, Sunswap seamlessly interacts with wallets such as TronLink and integrates with various TRON-based DeFi protocols. This interoperability simplifies portfolio management and broadens use cases.

The Algorithmic Edge

Sunswap’s AMM algorithm follows the constant product formula (x * y = k), which dynamically adjusts token prices based on pool ratios. This elegant yet powerful mathematical model ensures that liquidity is always available, albeit with price slippage that varies according to trade size relative to pool depth. The protocol also incorporates mechanisms to rebalance pools efficiently and reward arbitrage, thereby stabilizing prices.

The Road Ahead

As DeFi continues its inexorable growth, Sunswap is positioned to be a linchpin of decentralized trading on TRON. Future upgrades aim to introduce advanced features such as concentrated liquidity, cross-chain interoperability, and enhanced governance frameworks through SUN token voting.

Final Thoughts

Sunswap Exchange exemplifies how decentralized finance can democratize access to trading, reduce costs, and empower users with complete asset control. Whether you’re a seasoned DeFi enthusiast or a newcomer exploring decentralized ecosystems, Sunswap offers a sophisticated, secure, and highly efficient platform to trade and earn. In an era where autonomy over digital assets is paramount, Sunswap ensures that control truly remains in the hands of its users.

Made in Typedream